01- Usage of the ARCH package#

This setup code is required to run in an IPython notebook

%matplotlib inline

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style("darkgrid")

plt.rc("figure", figsize=(16, 6))

plt.rc("savefig", dpi=90)

plt.rc("font", family="sans-serif")

plt.rc("font", size=14)

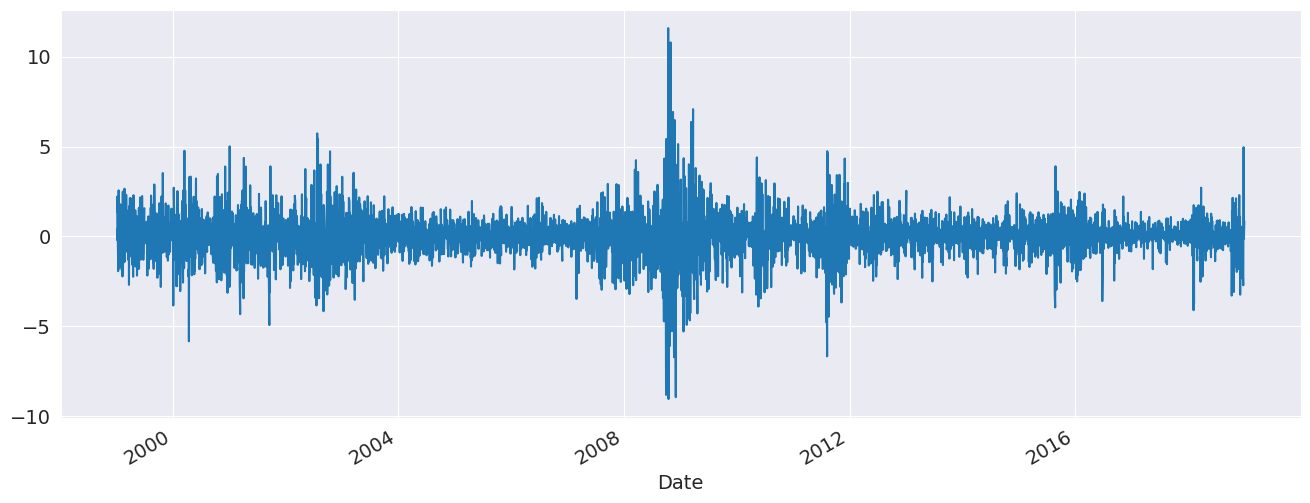

Data#

These examples make use of S&P 500 data from Yahoo! that is available from arch.data.sp500.

import datetime as dt

import sys

import arch.data.sp500

import numpy as np

import pandas as pd

from arch import arch_model

data = arch.data.sp500.load()

market = data["Adj Close"]

returns = 100 * market.pct_change().dropna()

returns

Date

1999-01-05 1.358200

1999-01-06 2.214041

1999-01-07 -0.205133

1999-01-08 0.422136

1999-01-11 -0.879151

...

2018-12-24 -2.711225

2018-12-26 4.959374

2018-12-27 0.856268

2018-12-28 -0.124158

2018-12-31 0.849248

Name: Adj Close, Length: 5030, dtype: float64

returns.plot()

<Axes: xlabel='Date'>

arch_model?

Signature:

arch_model(

y: 'ArrayLike | None',

x: 'ArrayLike2D | None' = None,

mean: "Literal['Constant', 'Zero', 'LS', 'AR', 'ARX', 'HAR', 'HARX', 'constant', 'zero']" = 'Constant',

lags: 'None | int | list[int] | Int32Array | Int64Array' = 0,

vol: "Literal['GARCH', 'ARCH', 'EGARCH', 'FIGARCH', 'APARCH', 'HARCH', 'FIGARCH']" = 'GARCH',

p: 'int | list[int]' = 1,

o: 'int' = 0,

q: 'int' = 1,

power: 'float' = 2.0,

dist: "Literal['normal', 'gaussian', 't', 'studentst', 'skewstudent', 'skewt', 'ged', 'generalized error']" = 'normal',

hold_back: 'int | None' = None,

rescale: 'bool | None' = None,

) -> 'HARX'

Docstring:

Initialization of common ARCH model specifications

Parameters

----------

y : {ndarray, Series, None}

The dependent variable

x : {np.array, DataFrame}, optional

Exogenous regressors. Ignored if model does not permit exogenous

regressors.

mean : str, optional

Name of the mean model. Currently supported options are: 'Constant',

'Zero', 'LS', 'AR', 'ARX', 'HAR' and 'HARX'

lags : int or list (int), optional

Either a scalar integer value indicating lag length or a list of

integers specifying lag locations.

vol : str, optional

Name of the volatility model. Currently supported options are:

'GARCH' (default), 'ARCH', 'EGARCH', 'FIGARCH', 'APARCH' and 'HARCH'

p : int, optional

Lag order of the symmetric innovation

o : int, optional

Lag order of the asymmetric innovation

q : int, optional

Lag order of lagged volatility or equivalent

power : float, optional

Power to use with GARCH and related models

dist : int, optional

Name of the error distribution. Currently supported options are:

* Normal: 'normal', 'gaussian' (default)

* Students's t: 't', 'studentst'

* Skewed Student's t: 'skewstudent', 'skewt'

* Generalized Error Distribution: 'ged', 'generalized error"

hold_back : int

Number of observations at the start of the sample to exclude when

estimating model parameters. Used when comparing models with different

lag lengths to estimate on the common sample.

rescale : bool

Flag indicating whether to automatically rescale data if the scale

of the data is likely to produce convergence issues when estimating

model parameters. If False, the model is estimated on the data without

transformation. If True, than y is rescaled and the new scale is

reported in the estimation results.

Returns

-------

model : ARCHModel

Configured ARCH model

Examples

--------

>>> import datetime as dt

>>> import pandas_datareader.data as web

>>> djia = web.get_data_fred('DJIA')

>>> returns = 100 * djia['DJIA'].pct_change().dropna()

A basic GARCH(1,1) with a constant mean can be constructed using only

the return data

>>> from arch.univariate import arch_model

>>> am = arch_model(returns)

Alternative mean and volatility processes can be directly specified

>>> am = arch_model(returns, mean='AR', lags=2, vol='harch', p=[1, 5, 22])

This example demonstrates the construction of a zero mean process

with a TARCH volatility process and Student t error distribution

>>> am = arch_model(returns, mean='zero', p=1, o=1, q=1,

... power=1.0, dist='StudentsT')

Notes

-----

Input that are not relevant for a particular specification, such as `lags`

when `mean='zero'`, are silently ignored.

File: ~/Documents/Projects/STI_FX_Intervention/.venv/lib/python3.9/site-packages/arch/univariate/mean.py

Type: function

Does anything beat GARCH(1,1)#

am = arch_model(returns, vol="Garch", p=1, o=0, q=1, dist="Normal")

res = am.fit(update_freq=5)

Iteration: 5, Func. Count: 35, Neg. LLF: 6970.277818445006

Iteration: 10, Func. Count: 63, Neg. LLF: 6936.718477482898

Optimization terminated successfully (Exit mode 0)

Current function value: 6936.718476989025

Iterations: 11

Function evaluations: 68

Gradient evaluations: 11

print(res.summary())

Constant Mean - GARCH Model Results

==============================================================================

Dep. Variable: Adj Close R-squared: 0.000

Mean Model: Constant Mean Adj. R-squared: 0.000

Vol Model: GARCH Log-Likelihood: -6936.72

Distribution: Normal AIC: 13881.4

Method: Maximum Likelihood BIC: 13907.5

No. Observations: 5030

Date: Tue, Apr 18 2023 Df Residuals: 5029

Time: 14:30:29 Df Model: 1

Mean Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

mu 0.0564 1.149e-02 4.906 9.302e-07 [3.384e-02,7.887e-02]

Volatility Model

============================================================================

coef std err t P>|t| 95.0% Conf. Int.

----------------------------------------------------------------------------

omega 0.0175 4.683e-03 3.738 1.854e-04 [8.328e-03,2.669e-02]

alpha[1] 0.1022 1.301e-02 7.852 4.105e-15 [7.665e-02, 0.128]

beta[1] 0.8852 1.380e-02 64.125 0.000 [ 0.858, 0.912]

============================================================================

Covariance estimator: robust

type(res)

arch.univariate.base.ARCHModelResult

am.fit?

Signature:

am.fit(

update_freq: 'int' = 1,

disp: "bool | Literal['off', 'final']" = 'final',

starting_values: 'ArrayLike1D | None' = None,

cov_type: "Literal['robust', 'classic']" = 'robust',

show_warning: 'bool' = True,

first_obs: 'int | DateLike | None' = None,

last_obs: 'int | DateLike | None' = None,

tol: 'float | None' = None,

options: 'dict[str, Any] | None' = None,

backcast: 'None | float | Float64Array' = None,

) -> 'ARCHModelResult'

Docstring:

Estimate model parameters

Parameters

----------

update_freq : int, optional

Frequency of iteration updates. Output is generated every

`update_freq` iterations. Set to 0 to disable iterative output.

disp : {bool, "off", "final"}

Either 'final' to print optimization result or 'off' to display

nothing. If using a boolean, False is "off" and True is "final"

starting_values : ndarray, optional

Array of starting values to use. If not provided, starting values

are constructed by the model components.

cov_type : str, optional

Estimation method of parameter covariance. Supported options are

'robust', which does not assume the Information Matrix Equality

holds and 'classic' which does. In the ARCH literature, 'robust'

corresponds to Bollerslev-Wooldridge covariance estimator.

show_warning : bool, optional

Flag indicating whether convergence warnings should be shown.

first_obs : {int, str, datetime, Timestamp}

First observation to use when estimating model

last_obs : {int, str, datetime, Timestamp}

Last observation to use when estimating model

tol : float, optional

Tolerance for termination.

options : dict, optional

Options to pass to `scipy.optimize.minimize`. Valid entries

include 'ftol', 'eps', 'disp', and 'maxiter'.

backcast : {float, ndarray}, optional

Value to use as backcast. Should be measure :math:`\sigma^2_0`

since model-specific non-linear transformations are applied to

value before computing the variance recursions.

Returns

-------

results : ARCHModelResult

Object containing model results

Notes

-----

A ConvergenceWarning is raised if SciPy's optimizer indicates

difficulty finding the optimum.

Parameters are optimized using SLSQP.

File: ~/Documents/Projects/STI_FX_Intervention/.venv/lib/python3.9/site-packages/arch/univariate/base.py

Type: method

Exercise:#

Change the code above to fit a zeromean model

Basic Forecasting#

Forecasts can be generated for standard GARCH(p,q) processes using any of the three forecast generation methods:

Analytical

Simulation-based

Bootstrap-based

Be default forecasts will only be produced for the final observation in the sample so that they are out-of-sample.

Forecasts start with specifying the model and estimating parameters.

forecasts = res.forecast(reindex=False)

Forecasts are contained in an ARCHModelForecast object which has 4 attributes:

mean- The forecast meansresidual_variance- The forecast residual variances, that is \(E_t[\epsilon_{t+h}^2]\)variance- The forecast variance of the process, \(E_t[r_{t+h}^2]\). The variance will differ from the residual variance whenever the model has mean dynamics, e.g., in an AR process.simulations- An object that contains detailed information about the simulations used to generate forecasts. Only used if the forecastmethodis set to'simulation'or'bootstrap'. If using'analytical'(the default), this isNone.

The three main outputs are all returned in DataFrames with columns of the form h.# where # is the number of steps ahead. That is, h.1 corresponds to one-step ahead forecasts while h.10 corresponds to 10-steps ahead.

The default forecast only produces 1-step ahead forecasts.

print(forecasts.mean.iloc[-3:])

print(forecasts.variance.iloc[-3:])

h.1

Date

2018-12-31 0.056353

h.1

Date

2018-12-31 3.59647

Longer horizon forecasts can be computed by passing the parameter horizon.

forecasts = res.forecast(horizon=5, reindex=False)

print(forecasts.mean.iloc[-3:])

print(forecasts.variance.iloc[-3:])

h.1 h.2 h.3 h.4 h.5

Date

2018-12-31 0.056353 0.056353 0.056353 0.056353 0.056353

h.1 h.2 h.3 h.4 h.5

Date

2018-12-31 3.59647 3.568502 3.540887 3.513621 3.4867

If you fail to set reindex you will see a warning.

forecasts = res.forecast(horizon=5, reindex=True)

forecasts.mean

| h.1 | h.2 | h.3 | h.4 | h.5 | |

|---|---|---|---|---|---|

| Date | |||||

| 1999-01-05 | NaN | NaN | NaN | NaN | NaN |

| 1999-01-06 | NaN | NaN | NaN | NaN | NaN |

| 1999-01-07 | NaN | NaN | NaN | NaN | NaN |

| 1999-01-08 | NaN | NaN | NaN | NaN | NaN |

| 1999-01-11 | NaN | NaN | NaN | NaN | NaN |

| ... | ... | ... | ... | ... | ... |

| 2018-12-24 | NaN | NaN | NaN | NaN | NaN |

| 2018-12-26 | NaN | NaN | NaN | NaN | NaN |

| 2018-12-27 | NaN | NaN | NaN | NaN | NaN |

| 2018-12-28 | NaN | NaN | NaN | NaN | NaN |

| 2018-12-31 | 0.056353 | 0.056353 | 0.056353 | 0.056353 | 0.056353 |

5030 rows × 5 columns

When not specified, or if reindex is True, then values that are not computed are nan-filled.

print(forecasts.residual_variance.iloc[-3:])

h.1 h.2 h.3 h.4 h.5

Date

2018-12-27 NaN NaN NaN NaN NaN

2018-12-28 NaN NaN NaN NaN NaN

2018-12-31 3.59647 3.568502 3.540887 3.513621 3.4867

Alternative Forecast Generation Schemes#

Fixed Window Forecasting#

Fixed-windows forecasting uses data up to a specified date to generate all forecasts after that date. This can be implemented by passing the entire data in when initializing the model and then using last_obs when calling fit. forecast() will, by default, produce forecasts after this final date.

Note last_obs follow Python sequence rules so that the actual date in last_obs is not in the sample.

res = am.fit(last_obs="2011-1-1", update_freq=5)

forecasts = res.forecast(horizon=5, reindex=False)

print(forecasts.variance.dropna().head())

Iteration: 5, Func. Count: 34, Neg. LLF: 4578.713304790317

Iteration: 10, Func. Count: 63, Neg. LLF: 4555.338449449297

Optimization terminated successfully (Exit mode 0)

Current function value: 4555.285110045399

Iterations: 14

Function evaluations: 83

Gradient evaluations: 14

h.1 h.2 h.3 h.4 h.5

Date

2010-12-31 0.381757 0.390905 0.399988 0.409008 0.417964

2011-01-03 0.451724 0.460381 0.468976 0.477512 0.485987

2011-01-04 0.428416 0.437236 0.445994 0.454691 0.463326

2011-01-05 0.420554 0.429429 0.438242 0.446993 0.455683

2011-01-06 0.402483 0.411486 0.420425 0.429301 0.438115

Rolling Window Forecasting#

Rolling window forecasts use a fixed sample length and then produce one-step from the final observation. These can be implemented using first_obs and last_obs.

index = returns.index

start_loc = 0

end_loc = np.where(index >= "2010-1-1")[0].min()

forecasts = {}

for i in tqdm(range(20)):

sys.stdout.write(".")

sys.stdout.flush()

res = am.fit(first_obs=i, last_obs=i + end_loc, disp="off")

temp = res.forecast(horizon=3, reindex=False).variance

fcast = temp.iloc[0]

forecasts[fcast.name] = fcast

print()

print(pd.DataFrame(forecasts).T)

....................

h.1 h.2 h.3

2009-12-31 0.615314 0.621743 0.628133

2010-01-04 0.751747 0.757343 0.762905

2010-01-05 0.710453 0.716315 0.722142

2010-01-06 0.666244 0.672346 0.678411

2010-01-07 0.634424 0.640706 0.646949

2010-01-08 0.600109 0.606595 0.613040

2010-01-11 0.565514 0.572212 0.578869

2010-01-12 0.599560 0.606051 0.612501

2010-01-13 0.608309 0.614748 0.621148

2010-01-14 0.575065 0.581756 0.588406

2010-01-15 0.629890 0.636245 0.642561

2010-01-19 0.695074 0.701042 0.706974

2010-01-20 0.737154 0.742908 0.748627

2010-01-21 0.954167 0.958725 0.963255

2010-01-22 1.253453 1.256401 1.259332

2010-01-25 1.178691 1.182043 1.185374

2010-01-26 1.112205 1.115886 1.119545

2010-01-27 1.051295 1.055327 1.059335

2010-01-28 1.085678 1.089512 1.093324

2010-01-29 1.085786 1.089593 1.093378

Recursive Forecast Generation#

Recursive is similar to rolling except that the initial observation does not change. This can be easily implemented by dropping the first_obs input.

import numpy as np

import pandas as pd

index = returns.index

start_loc = 0

end_loc = np.where(index >= "2010-1-1")[0].min()

forecasts = {}

for i in range(20):

sys.stdout.write(".")

sys.stdout.flush()

res = am.fit(last_obs=i + end_loc, disp="off")

temp = res.forecast(horizon=3, reindex=False).variance

fcast = temp.iloc[0]

forecasts[fcast.name] = fcast

print()

print(pd.DataFrame(forecasts).T)

....................

h.1 h.2 h.3

2009-12-31 0.615314 0.621743 0.628133

2010-01-04 0.751723 0.757321 0.762885

2010-01-05 0.709956 0.715791 0.721591

2010-01-06 0.666057 0.672146 0.678197

2010-01-07 0.634503 0.640776 0.647011

2010-01-08 0.600417 0.606893 0.613329

2010-01-11 0.565684 0.572369 0.579014

2010-01-12 0.599963 0.606438 0.612874

2010-01-13 0.608558 0.614982 0.621366

2010-01-14 0.575020 0.581639 0.588217

2010-01-15 0.629696 0.635989 0.642244

2010-01-19 0.694735 0.700656 0.706541

2010-01-20 0.736509 0.742193 0.747842

2010-01-21 0.952751 0.957245 0.961713

2010-01-22 1.251145 1.254049 1.256936

2010-01-25 1.176864 1.180162 1.183441

2010-01-26 1.110848 1.114497 1.118124

2010-01-27 1.050102 1.054077 1.058028

2010-01-28 1.084669 1.088454 1.092216

2010-01-29 1.085003 1.088783 1.092541